Average New Mortgages in Australia.

The following figures are calculated from the Australian Bureau of Statistics:

5609.0 – Housing Finance, Australia

6302.0 – Average Weekly Earnings, Australia

2010 – First Home Mortgages

| March 2010 | June 2010 | October 2012 | ||||||

| Ave Value | No of Loans | Ave Value | No of Loans | Ave Value | No of Loans | |||

| NSW | $304,400 | 2,545 | $309,200 | 2,418 | $307,800 | 2,088 | ||

| QLD | $286,400 | 1,552 | $279,000 | 1,226 | $276,200 | 2,116 | ||

| SA | $247,700 | 590 | $236,800 | 519 | $234,700 | 473 | ||

| VIC | $275,300 | 2,528 | $279,100 | 2,435 | $287,300 | 2,545 | ||

| WA | $288,000 | 1,157 | $281,600 | 967 | $296,700 | 1,661 | ||

| Tas | $179,400 | 143 | $192,300 | 117 | $200,600 | 130 | ||

| NT | $286,900 | 41 | $277,900 | 48 | $305,600 | 89 | ||

| ACT | $288,800 | 164 | $276,100 | 128 | $341,500 | 113 | ||

| Australia | $284,322 | 8,720 | $284,512 | 7,858 | $288,009 | 9,215 | ||

Assuming each New property buyer has one Male family member working full time, earning the average wage of about $70,000, then the average (2010) Australian First Home Mortgage would be 4.06 times the income.

However, if we assume that each new property buyer has one family member working part time, then the multiple could easily reach 7 or 8 times.

Mortgage Broker comparison figures

New mortgage figures from a Mortgage Brokers show the following figures. However, these figures may not agree with the normal bank lenders averages. These results are taken from 6,159 mortgages in June 2010 (about 800 first home mortgages), which is about 10% of the total mortgages per month.

June 2010

- $455,649 NSW

- $346,234 QLD

- $303,212 SA

- $353,886 VIC

- $386,513 WA

- $377,233 Australia

January 2010

- $397,888 NSW

- $320,579 QLD

- $286,101 SA

- $328,323 VIC

- $388,463 WA

- $349,604 Australia

In January 2010, 33.7% of mortgages were to Property Investors, 12.9% to First time buyers and 36.2% for refinancing purposes. ( it doesn’t say what the other 17.2% was for, maybe for normal house buyers, other than First homes)

December 2009

According to the ABS, the values of average new mortgages to First Home Buyers in December 2009 was:

- $312,400 NSW – Total First Home Buyer Loans numbered 3,440

- $279,400 Vic – Total First Home Buyer Loans numbered 3,561

- $286,400 QLD – Total First Home Buyer Loans numbered 2,008

- $242,500 SA – Total First Home Buyer Loans numbered 754

- $300,000 WA – Total First Home Buyer Loans numbered 1,835

- $207,700 Tas – Total First Home Buyer Loans numbered 203

- $340,100 NT – Total First Home Buyer Loans numbered 64

- $290,800 ACT – Total First Home Buyer Loans numbered 189

According to those numbers, the average First Home Loan for Australia in December 2009 was $290,100

Source: AustralianBureau of Statistics: 5609.0 Housing Finance, Australia Table 9b. (Owner Occupation), By Type of Buyer and Loan: State, Original

Australian Loan Value Ratios stated as % of property value

- Sep 2008 65.90%

- Oct 2008 68.70%

- Nov 2008 72.00%

- Dec 2008 70.80%

- Jan 2009 72.50%

- Feb 2009 72.70%

- Mar 2009 73.60%

- Apr 2009 73.70%

- May 2009 70.00%

- Jun 2009 66.90%

- Jul 2009 67.00%

- Aug 2009 66.30%

- Sep 2009 67.50%

- Oct 2009 65.00%

- Nov 2009 64.40%

- Dec 2009 64.10%

- Jan 2010 64.00%

April 2009

The following figures show the average New Australian Home Mortgage in April 2009, against the average Male Full time wage for each State.

- NSW $377,612 equal to 5.45 times Male income of $69,253

- QLD $336,166 equal to 5.05 times Male income of $66,518

- WA $387,187 equal to 4.76 times Male income of $81,276

- VIC $304,807 equal to 4.55 times Male income of $66,970

- SA $283,339 equal to 4.49 times Male income of $63,096

- NT n/a

- ACT n/a

- TAS n/a

- Australia in total $344,429

The average wages are based on ABS figures for each Australian State for February 2009.

More details and information on this at:

Average Existing Mortgages in Australia.

The following figures show the average existing Australian Home Mortgage in April 2009, against the average Male Full time wage for each State.

- NT $275,700 equal to 4.12 times Male income of $66,877

- NSW $283,300 equal to 4.09 times Male income of $69,253

- QLD $270,800 equal to 4.07 times Male income of $66,518

- VIC $249,000 equal to 3.72 times Male income of $66,970

- WA $282,800 equal to 3.48 times Male income of $81,276

- SA $214,800 equal to 3.40 times Male income of $63,096

- ACT 261,900 equal to 3.35 times Male income of $78,124

- TAS $191,700 equal to 3.20 times the above Male income of $59,872

The average wages are based on ABS figures for each Australian State for February 2009.

Average Existing Mortgages in each Australian State

NSW

In New South Wales, the average Home Loan in April 1979 was $25,400 In April 1989 it was $85,400, an increase of 218.1% over the previous 10 years. In April 1999 it was $158,500 an increase of 96.16% over the previous 10 years. In April 2009 it has become $283,300 an increase of 78.74% over the previous 10 years.

The NSW increase from 1979 to 2009 has been 1015.4%. This works out at an average annual rate of 8.4%

VIC

In Victoria, the average Home Loan in April 1979 was $24,300.

In April 1989 it was $68,400, an increase of 181.48% over the previous 10 years.

In April 1999 it was $123,500, an increase of 80.56% over the previous 10 years.

In April 2009 it has become $249,000, an increase of 101.62% over the previous 10 years.

The Victoria increase from 1979 to 2009 has been 924.7%. This works out at an average annual rate of 8.05%

QLD

In Queensland, the average Home Loan in April 1979 was $21,700.

In April 1989 it was $51,900, an increase of 139.17% over the previous 10 years.

In April 1999 it was $116,700, an increase of 124.86% over the previous 10 years.

In April 2009 it has become $270,800, an increase of 132.05% over the previous 10 years.

The Queensland increase from 1979 to 2009 has been 1147.9%. This works out at an average annual rate of 8.8%

WA

In Western Australia, the average Home Loan in April 1979 was $23,900.

In April 1989 it was $54,500, an increase of 128.03% over the previous 10 years.

In April 1999 it was $115,900, an increase of 112.66% over the previous 10 years.

In April 2009 it has become $282,800, an increase of 144.00% over the previous 10 years.

The Western Australia increase from 1979 to 2009 has been 1083.3%. This works out at an average annual rate of 8.6%

ACT

In the Australian Capital Territory, the average Home Loan in April 1979 was $23,300.

In April 1989 it was $59,400, an increase of 154.94% over the previous 10 years.

In April 1999 it was $130,900, an increase of 120.37% over the previous 10 years.

In April 2009 it has become $261,900, an increase of 100.08% over the previous 10 years.

The ACT increase from 1979 to 2009 has been 1024.0%. This works out at an average annual rate of 8.4%

SA

In South Australia, the average Home Loan in April 1979 was $23,600.

In April 1989 it was $53,100, an increase of 125.00% over the previous 10 years.

In April 1999 it was $91,900, an increase of 73.07% over the previous 10 years.

In April 2009 it has become $214,800, an increase of 133.73% over the previous 10 years.

The South Australian increase from 1979 to 2009 has been 810.2%. This works out at an average annual rate of 7.65%

TAS

In Tasmania, the average Home Loan in April 1979 was $21,200.

In April 1989 it was $39,500, an increase of 86.32% over the previous 10 years.

In April 1999 it was $83,900, an increase of 112.41% over the previous 10 years.

In April 2009 it has become $191,700, an increase of 128.49% over the previous 10 years.

The Tasmanian increase from 1979 to 2009 has been 804.2%. This works out at an average annual rate of 7.6%

NT

In The Northern Territory, the average Home Loan in April 1979 was $20,700.

In April 1989 it was $58,200, an increase of 181.16% over the previous 10 years.

In April 1999 it was $108,000, an increase of 85.57% over the previous 10 years.

In April 2009 it has become $275,700, an increase of 155.28% over the previous 10 years.

The Northern Territory increase from 1979 to 2009 has been 1231.9%. This works out at an average annual rate of 9.0%

The growth of average mortgages in Australia

From the above figures we can see the following average existing mortgage growth, between 1979 and 2009, for each state is:

- 9.0% Northern Territory

- 8.8% Queensland

- 8.6% Western Australia

- 8.4% New South Wales

- 8.4% Australian Capital Territory

- 8.05% Victoria

- 7.6% Tasmania

- 7.65% South Australia

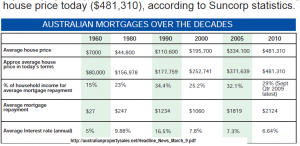

Abridged Suncorp Figures, from PDF Document: