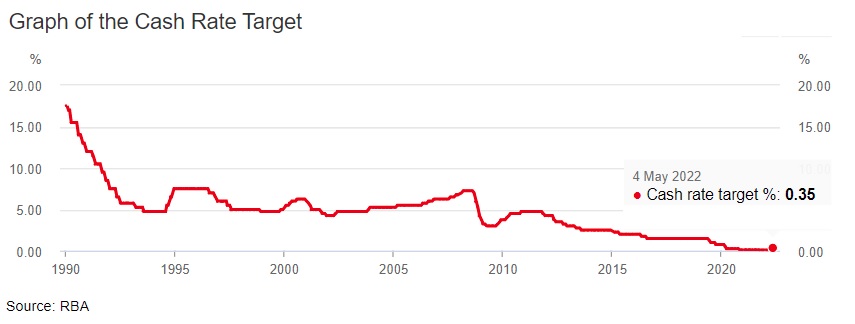

The RBA announced that the Australian Cash Rate would change to 0.35% on 3rd May 2022. The new rate comes into effect the day after.

It had been 0.10% from 4th November 2020, after dropping from 0.25% on that date.

This increase of 0.25 is a higher increase than some had expected.

3 May 2022 Media Release.

At its meeting today, the Board decided to increase the cash rate target by 25 basis points to 35 basis points. It also increased the interest rate on Exchange Settlement balances from zero per cent to 25 basis points.

Originally published 8:54pm 1 May 2022.

The Australian Cash Rate will be announced on Tuesday 3rd May 2022.

It has been stated that the main financial markets have already priced in a rise from the current 0.10% to an expected 0.25%, on 3rd May 2022.

It is also expected that further rises will occur in the months to follow, taking the official rate to 0.5%, and then 0.75%.

What is the NORMAL Australian Cash rate?

During the 10 year period 2000 to 2009, the rate varied between 3.00% and 7.25%. This shows what a normal cash rate might be. The current 0.10% is abnormally low.

What will this do to mortgage interest rates?

A guide to mortgage rates can be seen by looking at the banks fixed rates, for varying terms.

One example is the NAB Mortgage rates at 1 May 2022.

Current Fixed Rates are:

- 2.99% for 1 year term.

- 3.99% for 2 year term.

- 4.49% for 3 year term.

- 4.79% for 4 year term.

- 4.99% for 5 year term.

The current current variable rate is 2.19% at 1 May 2022.

Source: nab.com.au

Australian RBA Cash Rates between 2000 and 2021.

The highest rate during the years 2000 to 2021 was 7.25% in 2008.

- 2000 varied between 5.50% and 6.25%

- 2001 varied between 4.25% and 5.75%

- 2002 varied between 4.25% and 4.75%

- 2003 varied between 4.75% and 5.25%

- 2004 was 5.25% for the entire year

- 2005 varied between 5.25% and 5.50%

- 2006 varied between 5.50% and 6.25%

- 2007 varied between 6.25% and 6.75%

- 2008 varied between 4.25% and 7.25%

- 2009 varied between 3.00% and 3.75%

- 2010 varied between 3.75% and 4.75%

- 2011 varied between 4.25% and 4.75%

- 2012 varied between 3.00% and 4.25%

- 2013 varied between 2.5% and 3.00%

- 2014 was 2.50% for the entire year

- 2015 varied between 2.00% and 2.50%

- 2016 varied between 1.50% and 2.00%

- 2017 was 1.50% for the entire year

- 2018 was 1.50% for the entire year

- 2019 varied between 0.75% to 1.50%

- 2020 varied between 0.1% to 0.75%

- 2021 was 0.10% for the entire year

The history of recent changes to the Australian cash rate from the RBA is as follows:

- Reduced to 0.10% from 4 Nov 2020

- Reduced to 0.25% from 20 Mar 2020

- Reduced to 0.50% from 4 Mar 2020

- Reduced to 0.75% from 2 Oct 2019

- Reduced to 1.00% from 3 Jul 2019

- Reduced to 1.25% from 5 Jun 2019

- Reduced to 1.50% from 3 Aug 2016

- Reduced to 1.75% from 4 May 2016

- Reduced to 2.00% from 6 May 2015

- Reduced to 2.50% from 7 Aug 2013

- Reduced to 3.00% from 5 Dec 2012

- Reduced to 3.25% from 3 Oct 2012

- Reduced to 3.50% from 6 Jun 2012

- Reduced to 3.75% from 2 May 2012

- Reduced to 4.25% from 7 Dec 2011

- Reduced to 4.50% from 2 Nov 2011

- INCREASED to 4.75% from 3 Nov 2010

- INCREASED to 4.50% from 5 May 2010

- INCREASED to 4.25% from 7 Apr 2010

- INCREASED to 4.00% from 3 Mar 2010

- INCREASED to 3.75% from 2 Dec 2009

- INCREASED to 3.50% from 4 Nov 2009

- INCREASED to 3.25% from 7 Oct 2009

- Reduced to 3.00% from 8 Apr 2009