Australian Income Tax Rates for the year 2010/2011.

Index: Income Tax Rates in Australia

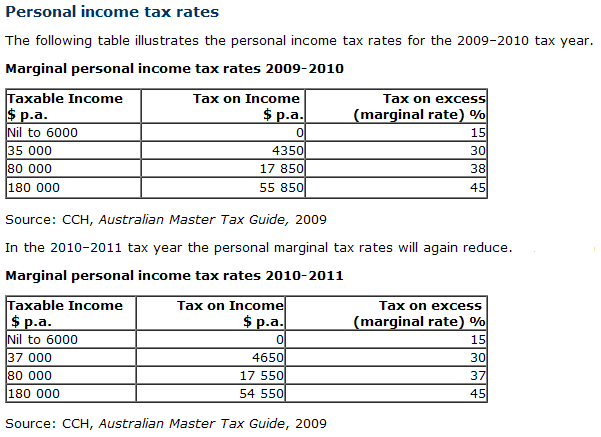

|

Taxable income |

Tax on this income |

|

$0 ?? $6,000 |

Nil |

|

$6,001 ?? $37,000 |

15c for each $1 over $6,000 |

|

$37,001 ?? $80,000 |

$4,650 plus 30c for each $1 over $37,000 |

|

$80,001 ?? $180,000 |

$17,550 plus 37c for each $1 over $80,000 |

|

Over $180,000 |

$54,550 plus 45c for each $1 over $180,000 |

* Low income earners under $16,000 will pay no tax, due to the Low Income Tax Offset.

The above rates DO NOT include the 1.5% Medicare levy

The following comparisons show the tax deduction differences for a selection of Gross Salaries:

- $30,000 Gross = 2009/10 tax of $3,600 with no change in 2010/11. No saving.

- $60,000 Gross = 2009/10 tax of $11,850 reducing to $11,550 in 2010/11. A $300 saving. ($5.77 pw)

- $90,000 Gross = 2009/10 tax of $21,650 reducing to $21,250 in 2010/11. A $400 saving. ($7.69 pw)

The Low Income Tax Offset (LITO) will however bring the net tax payable down for most people.

Weekly Tax Savings compared to 2009-10, according to figures released by the Treasurer:

| Annual Income | Weekly Tax cut |

|---|---|

| $15,000 | $0.00 |

| $20,000 | $2.88 |

| $25,000 | $2.88 |

| $30,000 | $2.88 |

| $35,000 | $2.89 |

| $40,000 | $8.66 |

| $45,000 | $8.66 |

| $50,000 | $8.65 |

| $55,000 | $8.66 |

| $60,000 | $8.65 |

| $65,000 | $7.70 |

| $70,000 | $5.77 |

| $75,000 | $5.77 |

| $80,000 | $5.77 |

| $85,000 | $6.73 |

| $90,000 | $7.70 |

| $95,000 | $8.65 |

| $100,000 | $9.62 |

| $105,000 | $10.58 |

| $110,000 | $11.54 |

| $115,000 | $12.50 |

| $120,000 | $13.46 |

| $125,000 | $14.42 |

| $130,000 | $15.38 |

| $135,000 | $16.35 |

| $140,000 | $17.30 |

| $145,000 | $18.27 |

| $150,000 | $19.23 |

| $155,000 | $20.19 |

| $160,000 | $21.16 |

| $165,000 | $22.12 |

| $170,000 | $23.08 |

| $175,000 | $24.03 |

The above figures will also include the Low Income Tax Offset amendments.