Queensland First Home Buyers.

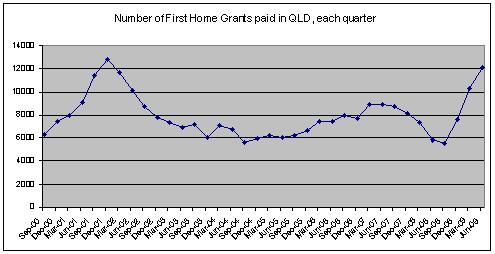

Number of First Home Buyer Grants issued in Queensland

- Jan-Mar 2010 5,816

- Oct-Dec 2009 8,235

- Jul-Sep 2009 10,231

- Apr ??Jun 2009 12,079

- Jan ??Mar 2009 10,334

- Oct ??Dec 2008 7,659

- Jul ??Sep 2008 5,523

The average for the previous three years, 2005 to 2007 was 7,816 grants per quarter (all at $7,000).

Out of 30,072 grants during Oct 2008 and Jun 2009:

- 3,183 got the full $21,000

- 21,797 got $14,000

- 5,092 received just the basic $7,000

This averaged out at $13,555 each.

This graph shows the numbers of basic Grants issued each quarter in Queensland.

Western Australia First Home Buyers.

In Western Australia, during the 2008-09 financial year, the number of loans issued to buy housing dropped by 11.7%, when compared to 2007-08.

- 2007-08 92,771

- 2008-09 81,875

However the numbers of First Home buyers, obtaining housing finance, increased by 26.4%

- 2007-08 16,445

- 2008-09 20,782

The figures for Non First Home buyers, showing a drop of20%, were:

- 2007-08 76,326

- 2008-09 61,093

An indication of the first two months of 2009-10 (July and August 2009 compared to July and August 2008) are:

- First Home Buyers – Up 56%

- Non First Home Buyers – Down 2%

New South Wales First Home Buyers.

In New South Wales, the number of First home buyers, purchasing a property with finance, changed over the last 13 months as follows:

Month : Number of dwellings financed : % of Total : Ave Mortgage size

- Sep-2008 2,977 = 20.58% $274,800

- Oct-2008 3,055 = 20.58% $283,300

- Nov-2008 3,895 = 25.09% $282,500

- Dec-2008 4,660 = 26.63% $282,500

- Jan-2009 3,732 = 26.97% $279,800

- Feb-2009 5,024 = 29.14% $292,300

- Mar-2009 6,317 = 30.11% $299,400

- Apr-2009 5,909 = 29.64% $299,400

- May-2009 6,394 = 30.15% $296,700

- Jun-2009 5,941 = 28.41% $282,300

- Jul-2009 5,449 = 25.88% $280,900

- Aug-2009 4,654 = 25.88% $283,600

- Sep-2009 5,236 = 26.69% $287,500

The NSW monthly average for last 13 months has been :

4,865 loans per month to First Home Buyers, or 26.90% of the total, with an average loan of $287,836 for each First Home financed.

Some interesting pieces of older information:.

During the period 1988-90 there were 290,000 first home buyers out of a total of 942,00 total Australian property purchases during that two years.

- 1988-90 30.7% were First Home Buyers Source PDF File

- 2007-09 26.3% were First Home Buyers in Australia Source – 5609.0 – Housing Finance, Australia

- 2007-09 21.3% were First Home Buyers in Western Australia

- 2007-09 28.3% were First Home Buyers in New South Wales

During the 1988-90 period the First Home buyer was aged between 25 and 34, and bought a 3 bedroom detached house with an undercover parking space.

The median price of Australian property in 1988-90 was about $85,000.

About 74% of First Home buyers had a household income exceeding $27,500.

34.8% of Australian households, during that time, had a Household income exceeding $42,500, whilst 43.8% of first home buyers exceeded that income.

Price range of property purchased in 1988-90

First Home Buyers

- 26.5% Under 62,500

- 23.3% $62,500 to $84,999

- 26.4% $85,000 to $119,999

- 23.8% Over $120,000

Non-First Home Buyers

- 11.8% Under 62,500

- 16.5% $62,500 to $84,999

- 28.9% $85,000 to $119,999

- 42.8% Over $120,000

First Home Owners in 1995, 1996, 2005 and 2006.

Number of First Home Buyers in Australia

- 1995-96 there were 318,200 First Home Buyers

- 2005-06 there were 303,300 First Home Buyers

1995-96

- 84.7% Detached House

- 7.9% Semi-detached, row, terrace or town house

- 7.4% Flat, unit or apartment

2005-06

- 72.3% Detached House

- 15.2% Semi-detached, row, terrace or town house

- 11.5% Flat, unit or apartment

Average Age of First Home Buyers in Australia

- 1995-96 32 years

- 2005-06 33 years

Sources: